Virtual Family Office Advisor (FOA)- Cohort II

Program Format: Virtual & In-Person

Program Fee: (Inclusive of GST) INR 29,500

- Live online sessions

- Complimentary access to all sessions of FOA Cohort I

- Pass to Priwexus's inaugural VFO Summit on June 9 in Mumbai

- Family Office Book

- Instructor PPTs

- Self-paced assignments

- Equalifi Virtual Membership fee (for 1 year)

- Exam Fee (1 attempt)

Equalifi’s Virtual Family Office Advisor Cohort 2 is tailored for industry practitioners who wish to have practical and in-depth understanding of family offices, especially in the Indian context. This program will equip wealth advisors and family office professionals with the qualitative skills needed to meet the demands of increasingly complex client relationships.

Participants will learn core knowledge, capabilities, tools and insights to support their clients in managing multi or single-family offices operations.

Who Should Attend

· Multi and Single-Family Office Representatives

· Wealth Planning Professionals

· Private Bankers and Client Relationship Managers handling UHNW and Family Office Segment

· Family Trust Consultants

· Private Client Practice Professionals including lawyers and accountants

· External Asset Management Professionals

· Financial Planners

Listen to our Faculty

What to Expect

A fast-paced learning approach with a cohort of peer advisors and family office professionals that begins with 9 virtual prep sessions, followed by a one day in-person intensive case study solving session and networking meet (in Mumbai), and concludes with a virtual assessment.

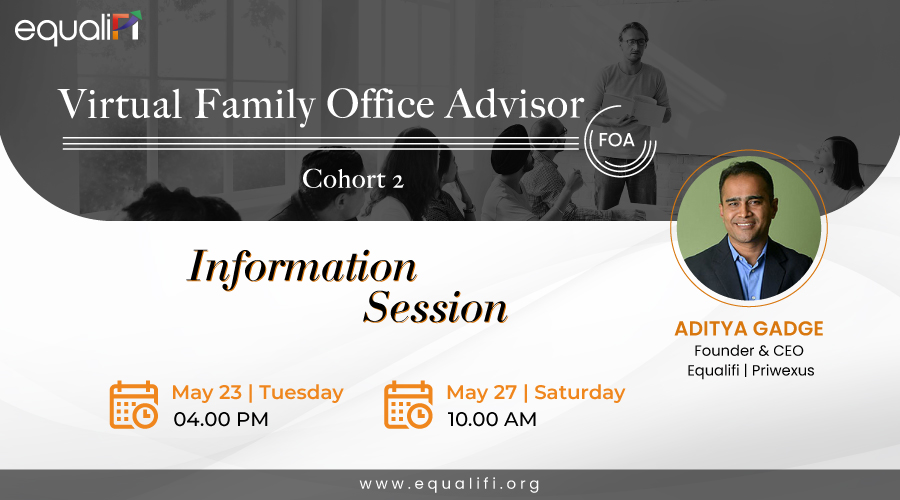

Information Session on Virtual Family Office Advisor (VFO)- Cohort II

To attend the FOA information session, please click here

| Session | Date | Day | Time | Topic | Faculty |

| 1 | June 12 | Monday | 4 pm- 5.30 pm | Cohort Launch & Introduction to Family Offices (Online Session)

| Aditya Gadge Founder Equalifi | Priwexus Co-Author- “Family Office” STEP Handbook |

| 2 | June 14 | Wednesday | 8 pm- 9 pm | Family Governance and Dynamics (Online Session)

| Dr. Krishnan N. Family Business Advisor |

| 3 | June 15 | Thursday | 4 pm- 5.30 pm | Succession Planning (Online Session)

| Tariq Aboobaker Managing Director Amicorp Trustees (India) |

| 4 | June 16 | Friday | 4 pm- 5.30 pm | Generating Alpha for Generations through a Family Office

| Philippe J. Weil Founder P.J.Weil Ltd |

| 5 | June 19 | Monday | 4 pm- 5.30 pm | Understanding Asset Allocation of Family Offices (Online Session)

| |

| 6 | June 20 | Tuesday | 4 pm- 5.30 pm | Family Office: Income-tax and Regulatory Considerations (Online Session)

| K T Chandy India co-leader EY Private TaxSurabhi Marwah India co-leader EY Private Tax |

| 7 | June 22 | Thursday | 9 am- 5 pm | VFO Summit 2023 ( In-person in Mumbai) | TBA |