Past Performance Is Not Indicative Of Future Returns: A Disclaimer That Often Goes Unnoticed.

Posted on: June 10, 2023 | By: Manju Mastakar, Managing Director, Armstrong Capital & Financial Services Pvt. Ltd.

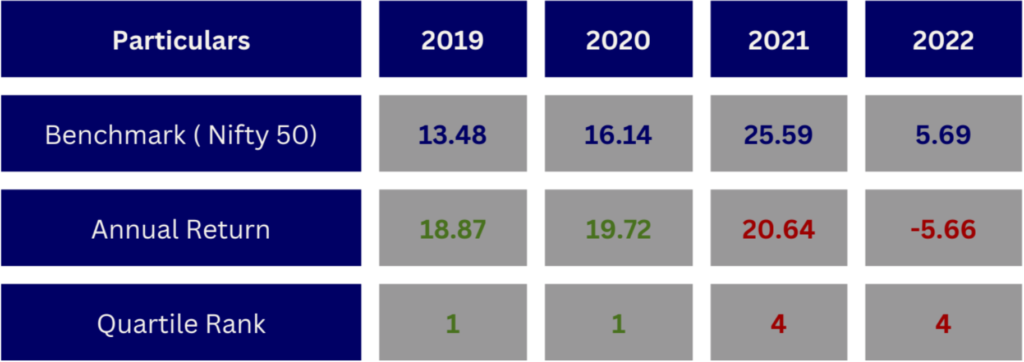

The Case of Axis Bluechip Fund:

In December 2019, Investor A identified Axis Bluechip as the best performing fund of the year, surpassing the benchmark by an impressive 39%. Fuelled by this remarkable performance, Mr. A presumed that the fund would continue its upward trajectory. However, the subsequent years of 2021 and 2022 saw a significant shift in the fund’s performance. Axis Bluechip Fund moved from the top quartile, where it had previously thrived, to the bottom quartile. Moreover, it underperformed the benchmark, causing disappointment among investors who had blindly relied on its past achievements.

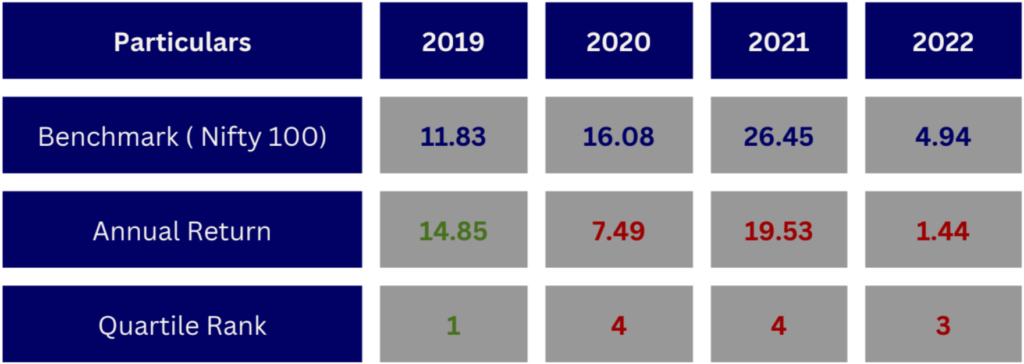

The DSP Top 100 Fund Dilemma:

Similarly, investors who placed their faith in the DSP Top 100 Fund based on its strong performance in 2019 faced an unexpected turn of events. Despite its prior success, the fund experienced a sharp decline in rankings, transitioning from a top-performing scheme to one at the bottom.

Shattering Illusions:

The rise of fintech apps has made investing more accessible than ever before, offering investors unprecedented accessibility to past performance data of various funds. Armed with this information, investors often make investment decisions based on the current top-performing schemes, only to realize that rankings can swiftly change. It becomes evident that performance is not a constant but a dynamic element in the investment landscape.

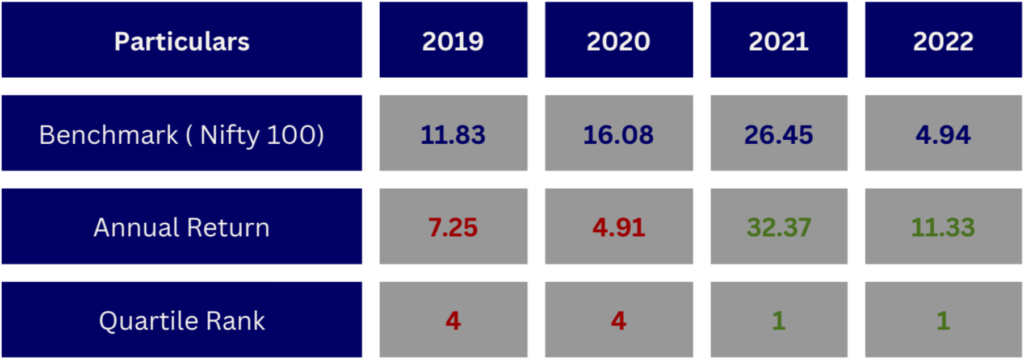

Investors frequently find themselves shifting their investments based on the latest rankings, assuming that past success will continue unabated. However, the story of Nippon Large Cap Fund showcases the inherent unpredictability of investment performance.

The Case of Nippon Large Cap Fund:

Despite being ranked poorly in the fourth quadrant in both 2019 and 2020, the fund experienced a remarkable turnaround in subsequent years. It rose to become the best-performing fund, demonstrating the dynamic nature of investment performance and providing valuable insights to investors.

Navigating the Uncertainty

What causes such significant shifts of funds between the first and fourth quadrants?

There are several reasons why a fund may fail to deliver the expected returns, and it’s important to understand these factors.

Probability:

Investing in stocks by a mutual funds is akin to playing a game of probability. Just like rolling a dice doesn’t guarantee a six, picking the next winning stock idea is luck based sometimes.

Perception:

The anticipation of a stock’s potential growth by a fund manager may not always materialize. When we examine a scenario where a fund manager selects 40 stocks. In one year, 35 of the chosen stocks perform as predicted and that’s why the fund outperforms the peers, while in the following year, only 26 stocks meet the expected performance so the fund underperforms its peers. This example highlights the inherent uncertainty and variability in the market, emphasizing the need to acknowledge that a fund manager’s perceptions may not consistently align with the actual outcomes.

Breather Impact:

A fund may have outperformed after experiencing a sharp rally in prices of stocks that they were holding after which the stocks experience a breather, where their prices stagnate or correct. During this phase, the fund manager needs time to reassess the market conditions, identify new investment opportunities, and strategically exit stocks that may have reached their peak. This process of transitioning and finding new investment ideas can take time and may not always yield the same level of success and the fund’s performance may suffer, resulting in a lower ranking compared to its peers.

Fund Manager Transition:

The departure of a fund manager can be a significant concern for the performance of a fund. The fund manager’s skills and expertise play a vital role in shaping the fund’s portfolio, as they are responsible for selecting stocks and implementing investment strategies. When a fund manager leaves their role, the brainchild behind the stock picking may no longer be present. In such cases, the new fund manager who takes over will likely have their own investment philosophy and approach. They may feel the need to restructure the portfolio according to their own strategic vision. This transition period can take several months and could create uncertainties and temporarily disrupt the fund’s performance.

Variance with the benchmark:

This parameter highlights the degree to which a fund manager has constructed a portfolio that differs from the benchmark index. A portfolio with low variance can generate an alpha as the stocks that the funds hold can perform better than the Index so it outperformance and the reverse also holds good for underperformance. In conclusion, investors need to recognize that fund management styles are cyclical, meaning that different mutual fund schemes will perform differently at various points in time. Relying solely on past performance rankings can lead to suboptimal investment decisions, as the top-performing funds today may not necessarily maintain their success in the future.

It is crucial for investors to pay heed to the “warning label” included in every document discussing mutual funds: “The past performance of the mutual funds is not necessarily indicative of the future performance of the schemes.” Regrettably, this disclaimer often goes unnoticed by DIY investors.

Taking a comprehensive approach that incorporates various factors and diversifies investments can lead to more balanced and resilient portfolios, better suited to weather the ups and downs of the investment landscape over time.