Alternative Investment Funds en route to becoming Mainstream investments

Posted on: November 18, 2021 | By: Leelavathi Naidu- Partner, Funds, Asset Management and Regulatory practice, IC Universal Legal

Globally, the year 2020 was a looming year for the businesses across sectors and several of them dealt with major financial blow. On the other hand, Alternative Investment Funds have been resilient and tided over the storm that took over the world markets. With over 750 Alternative Investment Funds registered, the investment landscape is changing with investors (Domestic & Global) believing in the India Growth Story. In its latest report of Global Limited Partner Survey of 2020, India ranks third (just after Southeast Asia and China) as the most preferred platform for alternative Investment.

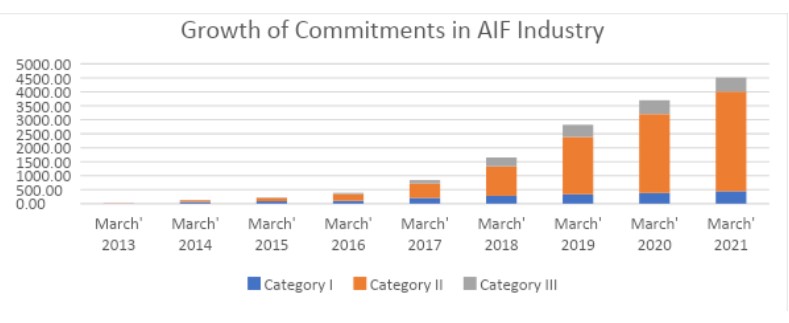

This is evidenced by the growth that alternative investment funds have seen since 2012. Commitments raised by AIFs reached around INR 4.51 Trillion by March 2021, posting growth in commitments of 90% since the introduction of AIF regulations in 2012.

Rs. In Billions

Source: Sebi.gov.in

As evident from above, Category II AIF schemes dominate the AIF industry with 79% of the Commitments and 67% of the investments made (INR 1.40 trillion deployed in the market). In spite of pandemic hit in 2020, Category II AIFs have seen steady growth in Commitments and investments. Category II AIFs must primarily invest in unlisted space and can be sector agnostic. Further, a tax pass through status for Category II AIFs have made them the most sought-after investment platform.

Let us analyse on the few factors which have aided the growth for Alternative Investment Funds:

- Favourable Regulatory Environment:

The most important vector for the success of any regime is how conducive regulations are. SEBI as a regulator worked tirelessly with participants of the industry and its admirable how SEBI have been cautiously but steadily, working on streamlining and supporting the regulatory and governance framework for growth of AIFs.

“Additionally, with the advent of GIFT IFSC, the regime for alternative investment funds, the technical and tax issues are continuously being resolved by the regulators giving immense comfort to the participants. The same has not gone unnoticed by the global investors who have been looking at entering Indian alternative investment space.”

- Rise of HNIs & Unicorns

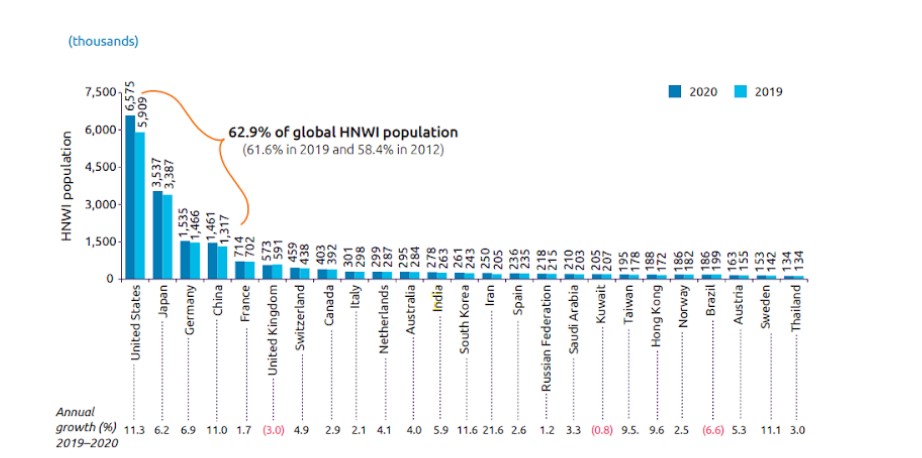

The pandemic while it impacted the globe, it did have a silver lining. During this phase , India continued to hold on to the 12th position in the Global High net worth population housing 2,78,000 Ultra High Net Worth Individuals (UHNIs):

Source: World Wealth Report 2021 (Capgemini Financial Services Analysis, 2021)

India is one of the fastest-growing economies with a vibrant ecosystem and the third-largest start-up ecosystem. Last year saw a spurt in the growth of 11 new unicorns (valuation of $ 1 billion and above), the highest ever in a single year.

- Tech & digitization

The pandemic did lead to accelerated adoption of technology and online services etc The rate of digital adoption by the Indian users and Start ups using this to their advantage has become the real delta in driving the significant fundraising in the year 2020. AIFs were the framework that supported the funds to invest in start-ups and mutually benefitted from the uproar in the venture ecosystem and overall regulatory and infrastructure development inviting more public and private participants.

Potential for Alternative Investments to grow

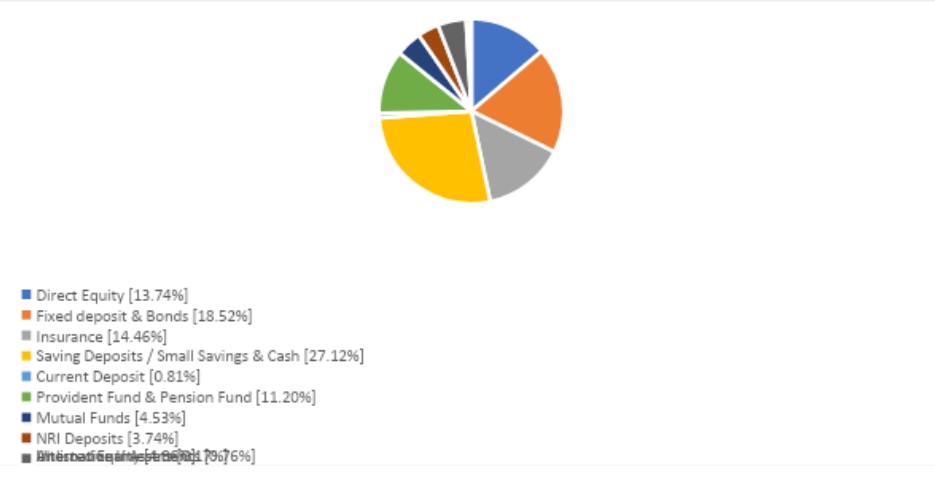

India, traditionally has been a savings economy with major investments being in Bank Deposits and safe investments like Provident Funds, Pension Funds, Insurance and Mutual Funds to quite an extent.

In its recent India Wealth Report’ 2020, investments towards Alternative platform have seen a slight shift from 0.58% (in 2019) to 0.76% of investment in financial assets (in 2020). The shift to high yielding assets, more products to diversify investment interest etc has already triggered a shift in the allocations and which is where the UHNIs, Family offices are finding AIFs most suitable.

Source: India Wealth Report, 2020 [issued by Karvy Private Wealth]

The growth cycle will continue considering there has been a paradigm shift for HNIs from traditional investments to exploring alternative platforms which can offer more diversification and reduced volatility in the portfolios.

Inspite of the nascency of AIFs more and more investors want to invest in sophisticated and curated investment products meeting their risk and return appetite beyond listed securities. AIF fits the bill for such investors.

Alternatives to go mainstream – readiness status

Regulatory changes, tech & digitization lead to higher adoption of this alternatives by HNIs & UHNIs aided the growth of the alternative space. As we move ahead asset managers are upscaling their game to meet the surge in demand from the investors. Some of the areas where AIFs are working towards are :-

- Alignment of interest:

AIF managers are mindful of a distributor-centric model of channelling funds. AIFs (Specifically Category I & II) shouldn’t just become a mere product class instead of ownership-driven structure that aligns interest of the manager, key personnel and distributor with the interest of the investors. The focus is being built to enhance technical awareness on the product and risk / reward quotient.

- Risk management and transparency: Strong risk management and corporate governance capabilities are highly valued by investors. Alternate managers are now undertaking capability building in transparent risk disclosures and client reporting procedures.

- Awareness v/s Accreditation: SEBI took its first step in coming out with granting of Accredited status. However, investing in a complex and sophisticated product requires investors to be aware of the risk/return ratio and not only networth. While Investors do usually sign the standard distribution agreement the sophistication of being aware of the product is more essential for the alternatives platform.

USA does permit retail investors who have awareness and would like to sign up to the risk-return can very much invest in alternative investment products. Singapore also carves out fund managers, research analysts, professional investors as part of Accredited investors irrespective of their net worth considering their investment experience and understanding of the product.

- Curation of Products: Keeping in line with alternative asset classes, asset managers have been offering structured and curated products. A lot of untapped opportunities in distressed assets, currency, and commodities-centric products etc. are yet to be explored. With progressive regulations and more asset classes opening up under the over arching alternative regime , industry will see curation and innovation in the product assembly line.

AIFs have participated in massive private capital infusion in the Indian economy across several segments: healthcare, infrastructure, affordable housing, manufacturing, logistics, IT, financial inclusion, banking, financial services, insurance, consumer products and services, education, etc. Given various constraints faced by the traditional lending ecosystem in the last decade, the role of alternative capital in supporting India’s economic growth aspirations and reducing the strain on government finances is commendable.

As the HNIs and Unicorns amass wealth (as per India wealth report of 2020 estimated become INR 799 lakh Cr with CAGR growth of 13.66%), Alternative Investments will be receiving more participation from these segments.

The question is how is the alternative industry geared to be well positioned or best positioned to meet the demand from the investors which comes along with mainstream investments.