Private credit or debt – an evolving asset class in India

Posted on: May 29, 2023 | By: Atul Muchhala – Executive Director - Head India Operations, IQ EQ <br> Sandipan Saha – Associate Director – Business Development, IQ EQ

Emergence of private debt

There has not been a time in recent history when global scenarios or macro-economic factors have changed so extensively as in the last few years. A series of events from 2020 onwards – starting with the pandemic, to current changes in geopolitical equations owing to war, rising interest scenarios, debt obligation of the developed countries or rising inflation – impacted day-to-day life of the global population. These events have far-reaching effects and are scaling new highs with each passing day, reducing visibility on when the impact of these events will slow down.

As a natural consequence of rising interest rates, the borrowing cost on all financial instruments have skyrocketed. The availability of traditional finances to borrowers from banks, non-banking financial companies (NBFC) and financial institutions slowed down. Moreover, these lending institutions have been very cautious with profiling their client base and assigning credit ratings.

In this current post pandemic era, some of the global economies, including India, are witnessing a V-shaped recovery with sectors like manufacturing and services booming. This recovery trend needs support through higher fund allocation towards working capital and industrial investments. The emergence of micro, small and medium enterprises (MSME) aptly supported this recovery and in a country like India, it started standing hand in hand with organised industrial sector. Drying up or slowing down of the traditional finance sources allowed the market participants to look for a source of fund which can help them sustain not only their near-term growth but also support their expansion and capital-intensive investments.

Private debt or credit as borrowing strategy evolved in India owing to the above reasons. This asset class, available in the developed countries, enabled the fund managers in India to set up an alternative investment fund which is also providing higher returns.

Fund type or strategies of private debt

There are several ways to do private debt, also known as private credit. Private debt is essentially non-bank, predominantly institutional, lending to private companies or buying their loans on the secondary market. The main private debt sectors are:

Direct lending: These are usually senior loans made to mid-market companies without an intermediary.

Distressed debt: Distressed debt often does not cover the origination of new debt. It normally involves the purchase of securities in the secondary market.

Infrastructure debt: Debt used for infrastructure development usually has very long terms because of the extended life of the assets.

Mezzanine debt: This is subordinated debt and often includes a preferred equity feature such as warrants. Mezzanine debt is often used in leverage buyout situations.

Real estate debt: This is lending extended for real estate acquisitions. It can also include the buying and selling of secured real estate loans in secondary market.

Special situations:This generally refers to either debt or structured equity investments that are made to take control of a company that is usually in distress.

Venture debt: This is debt financing for companies with venture capital backing.

Private debt as an asset class

The 2008 crisis was the turning point for private debt. Bank lending shrank as they were forced to repair their balance sheets. However, in the aftermath of the known recession, companies especially the mid-market ones were in urgent need of capital. Private lending stepped in to fill the space in the market that had been vacated by the banks.

The market was developed by large private equity managers with credit arms, such KKR and Blackstone. Particularly in Europe, large established fund groups have got into the private debt market too. They include managers like M&G, Schroders, Amundi and Standard Life Aberdeen. Over 70% of the investor capital for private credit comes globally from institutional investors [2].

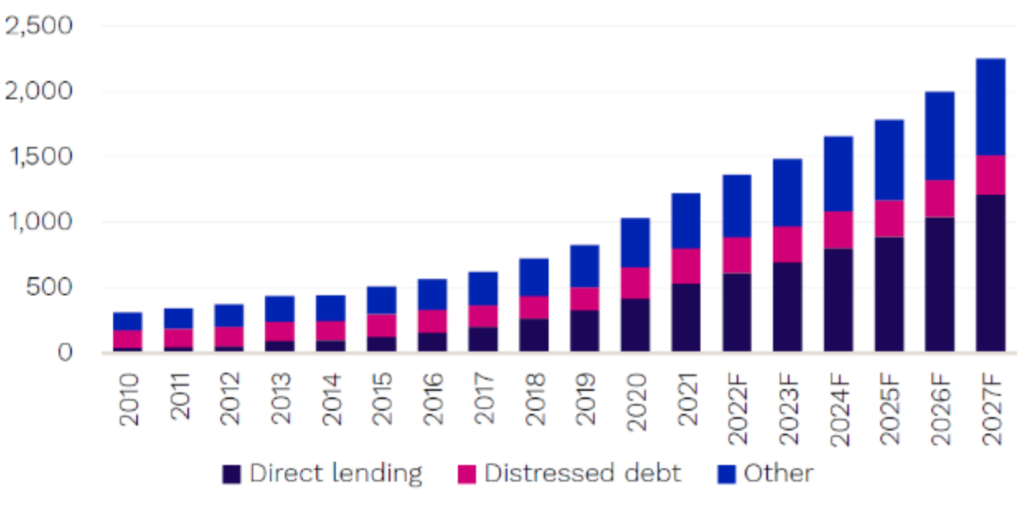

Globally the Private Credit AUM has grown by ~3 times from $ 342 Bn in December 2011 to $ 1.4 Tn in June 2022[3]. The number of private credit funds also doubled from 104 in 2010, to 222 in 2022[3]. The asset allocation under management to private credit is around 10% to 15% of the private capital which includes private equity, venture capital, real estate.[4]

Global private debt AUM ($Bn) by sub-strategy, 2010-2017F

The forecasted AUM of private debt is $1.8 Tn by 2025. There has been a slight downside revision in the forecast in the 2023 preqin report largely due to the global inflationary and high interest rate situations.[1]

Impact of pandemic and geopolitical change

In 2022, globally there has been a sharp movement in interest rates on fixed income assets. In addition to this inflationary pressure came from the energy sector which rose by 34.6% over 12 months, the biggest 12 months increase since September 2005[5]. There were also movements in US 10-year treasury yields. There was continuously tightening by Fed, European central bank, and Bank of England. During the quarter, some fresh fiscal measures were announced in UK, which were not welcomed by the capital markets. The pound went to an all-time low against US dollar.

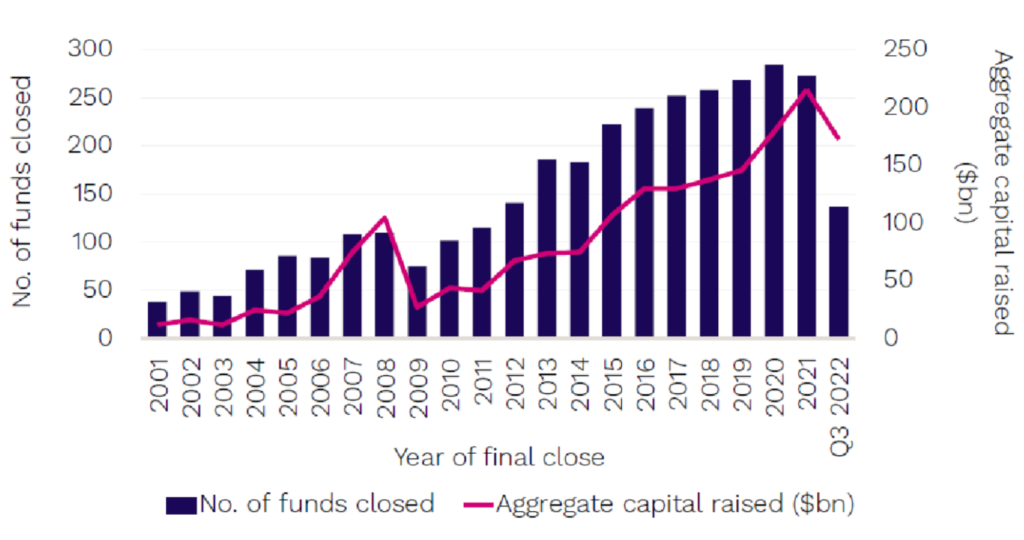

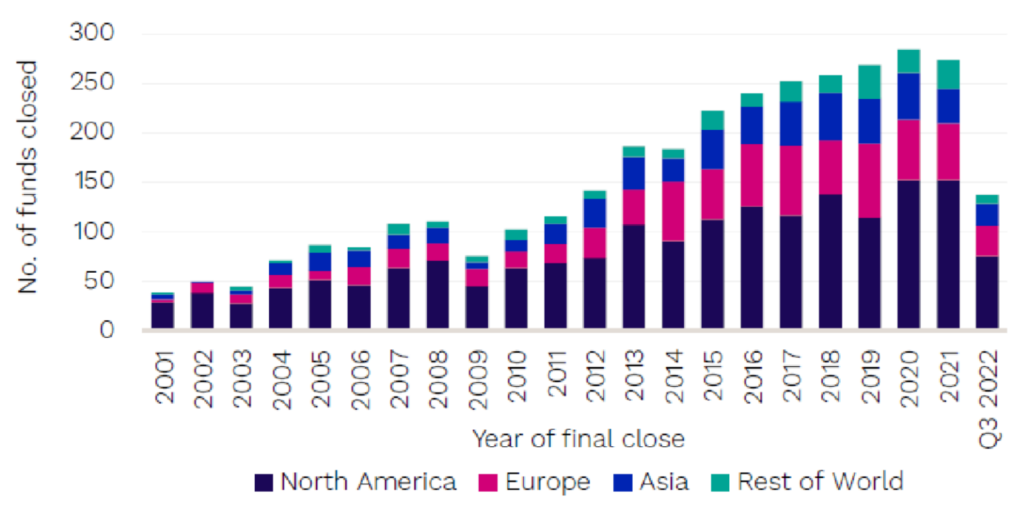

From the graph below it is evident that till September 2022 the fund raising was in similar pace as that of 2021, which was itself a record-breaking year. However, the number of fund closings decrease substantially. This showed that investors were cautious about the asset managers and made allocations to fewer of them.

There has been a decline in fund raising for first time fund managers and the steady growth of experienced fund manager is also seen over the last years. The established fund managers with good track record and experience in previous funds clearly gain confidence of the global LPs along with the borrowers.

Preqin report also suggested that the fund raising in the first quarters of 2022 globally were concentrated by top 10 funds contributing to 50% of all capital raised as compared to 36% compared to 2021[1]

In fund raising, mezzanine debt hit new highs across the strategy reaching $43.5 Bn, beating the full year figures from 2001 to 2021[1]. Distressed debt has had a weak year, with funds focused on the strategy, raising $6.7bn by the end of Q3 2022, compared to $43.0bn in 2021 and $45.1bn in 2020 [1]. This may be because the distressed investment opportunities were reduced post pandemic.

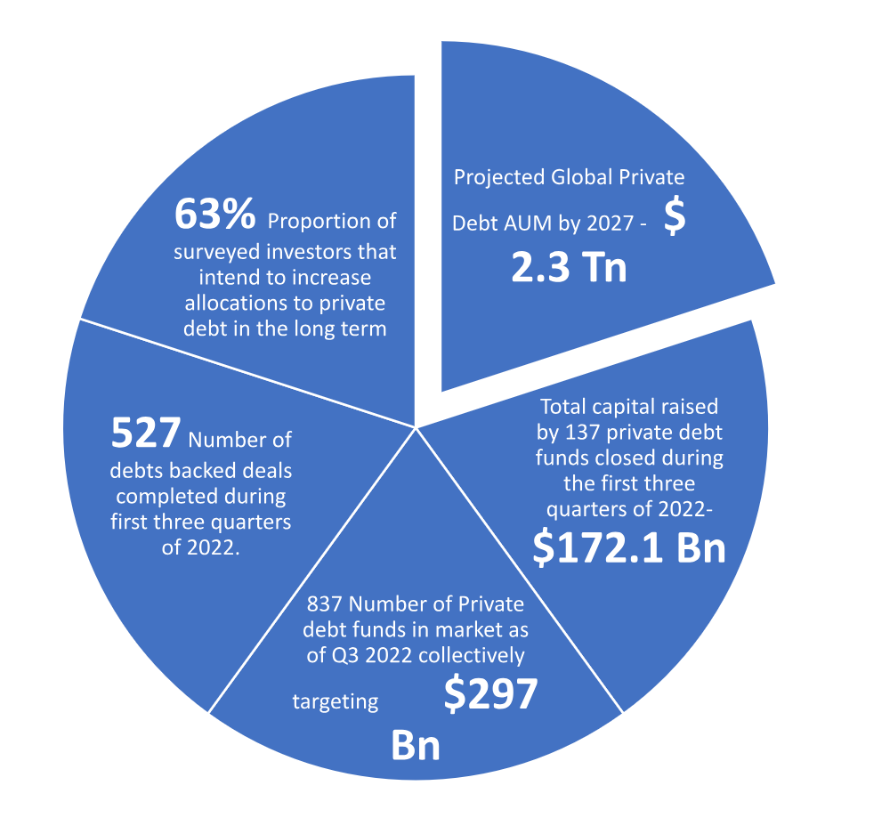

Key Facts [1]

Why investors prefer private debt or credit

Many private debt fund managers opt for floating rates, so the asset class remains largely protected from interest-rate and inflation risks. As it is presumed to be less impacted by central bank intervention, more institutional investors are turning to private debt and it also caught the attention of non-institutional investors. Despite the economic scenario, investors seem to prefer this asset due to its reliable or regular income stream and diversification benefits.

Investors favour private debt as returns are typically less volatile than from equities. Private debt offers investors capital preservation, and it is a structured investment with set repayment terms. In addition to being backed by real assets, another attraction of private debt is the relative low correlation with traditional asset classes. This is partly because market covers SMEs and mid-market companies that are otherwise difficult to reach for investors.

However, there are risks. In the event of a default, the cost and difficulty to collect payment are higher than in public credit. Also, there isn’t a well-developed market for private debt which means that this asset class is primarily for long term investors who are happy to hold till maturity.

Global split of private debt

The US is by far the most developed and dominant market for private debt. Europe is second with fewer lenders, while the Asia pacific region is further behind but has grown every year since 2010. In terms of geographic split, North America shares most (~60 to 65% by capital) number of private debt funds, followed by Europe (~25%) and Asia[1] . If gone by the count of the funds, Asia’s share would be 16% by count and 4% by capital[1], and despite being a small region when measured by capital growth, there are substantial activities and potential for growth. In Europe, the private debt is issued just as a single tranche of debt, while in the US it is more usual to have mezzanine-debt layer or second lien below the first lien.

Private credit in India

India’s credit market has been primarily dominated by public sector undertakings (PSU) banks and NBFCs for a long time, and then the private banks came into the mix.

When the economy grows, there is an obvious demand of credit in the country for growth capital and debt refinancing. Due to rapid technological advancement and new advanced lending models supported by tech, banks are slowly focusing on the retail market in India. This additionally helps them to diversify their risk portfolio and reduce exposure to corporate debt.

Out of India’s total lending market of Rs 174 lakh crore (USD 2 Tn) as of March 2022, retail loan book is at 48.9%, commercial loan book at 49.5% and balance is from micro finance lending[6]. Retail loans grew by 13.6% as compared to commercial loans which grew only by 8.6% to INR 2.9 Lakh Crores (USD 1 Tn) in FY 2022[6]. Hence there seems to be a definite market for corporate credit in India.

India target to become a US$ 5 Tn economy, so it is estimated that at least 50%, which is more than US$ 2.5 Tn in credit, would be required to support the growth[4]. Hence private credit becomes the need of the hour for capital hungry corporates as the banks and NBFCs being over cautious after the major defaults in the last 3-4 years and slowed down on their corporate lending book.

After the global financial crisis and the debacles of large NBFCs, lot of banks, non-bank lenders have migrated to retail and cut their positions in Mid corporate segment. This mid corporate segment has faced lack of access to debt.

With the discontinuance of Long-term capital gains and indexation benefits of Debt mutual funds, this debt AIF asset class for HNIs and large family offices is expected to become attractive. The ‘performing credit’ asset class of debt AIFs which expects to generate a return anywhere between 12% to 18%, which targets the mid corporates with good governance and businesses with lower credit ratings looking to raise growth capital. The special situation, distressed funds would be expected to generate higher returns of somewhere between 18% to 24%.

As per Preqin fund manager survey in November 2022, India ranks top in the emerging markets targeted by private debt fund managers in the next 12 months.

Structures for foreign investment in India for private debt

Insolvency and bankruptcy (IBC) laws were first introduced in 2016 in India. It suggested for a time bound and creditor driven resolution process for distressed companies, overseen by the national company law tribunal (NCLT). As a result of this, the Reserve Bank of India (RBI) forced banks to file insolvency applications against defaulting borrowers under the IBC. This has opened foreign investments in India in distressed assets through debt platforms like asset reconstruction company (ARC), NBFC, AIF, foreign portfolio investment (FPI) and external commercial borrowing (ECB)

- Asset Reconstruction Company (ARC): ARCs buy non-performing assets from banks and financial institutions. Foreign investment can be done in ARC either by setting up an ARC or through investing in an existing ARC. The ARCs manage securitisation trust. It transfers the non-performing assets into a trust and issues Security receipts (SRs) to qualified intuitional buyers of the trust. ARCs charge a management fee by selling / enforcing the debt in the trust.

- FDI is allowed in NBFC. However, NBFCs can purchase debt which is before default for 61 days unlike ARCs.

- Alternate Investment funds (AIF):

- Foreign investors can invest in AIF through various structures into their preferred asset class under automatic route.

- AIFs can also invest in SRs issued by ARCs.

- AIFs allows Foreign investors to invest in listed and unlisted debt instruments which would otherwise require RBI approval.

- Debt – Cat II AIFs also provides pass through status so no additional tax at trust level. Private debt would fall in this category largely.

India’s alternative investment fund (AIF) industry has doubled to $72 billion as of September 2021 from $36 billion in 2016 end – an increase of more than 100% in assets under management (AUM) for registered funds alone – according to a report. Out of little more than 1000 AIFs registered with SEBI for Category I, II & III, the Category II AIFs are close to 80% in number.

- Foreign Portfolio Investors (FPI)

- An FPI license is required, however there are various limitations for foreign investors through this route

- FPIs can purchase SRs issued by ARCs and to invest in Indian corporates by NCDs.

- ECB (External commercial borrowings): Foreign investors can use ECB route as well, however there are certain limitations for the type of borrowers they can lend to, usage of funds and the cost of borrowing as well

GIFT City a new jurisdiction

Gujrat International Fin-Tec City is developing as a global financial and IT services hub. It is included as a Special Economic Zone having the status of International Financial Services Centre (IFSC). As an effort to facilitate growth in IFSC, remarkable regulatory reforms have been introduced in the regime governing Funds in IFSC. The government is also trying to promote this actively to global funds including private debt funds looking to invest in India. In areas like Aircraft Leasing in Gift city, private debt funds can be an option to help the industry grow in the area. India has also the cost efficiency factor unlike most markets in the world. Overall, investors who already have some exposure to India should be able to get some comfort while investing in Gift city Funds. The regulator for IFSCs in India, has allowed resident Indians to use the Liberalised Remittance Scheme (LRS) to invest in the IFSC at GIFT City in Gujarat.

Attractiveness of private debt funding features

- For Investors

- Investors get co-investment opportunities with sponsors and general partners GPs.

- Investors get higher yields, regular distribution, and diversification benefits.

- The fund houses can give strategic inputs to the businesses they invest in due to their wide expertise and knowledge levels.

- LTCG gains and indexation benefits of Debt Mutual Funds being scrapped recently, so focus of the investors would be largely on the pre-tax gains, hence Private credit inflow into debt AIFs from large family houses might increase.

- For Borrowers

- There is demand of this type of credit by the mid-sized companies as after the 2008 crisis globally banks have become more risk averse and moved away from mid corporates to less risky large corporate businesses.

- Terms are flexible to decide on the repayment structures, collateral, interest rates, tenures. This helps the company to match their business cash flows.

- Execution is very fast unlike in banks as the fund houses structure is flat and the team does not have too many bureaucratic levels.

Challenges of Private Credit in India

- It caters to the sophisticated investors like large family offices or HNIs only.

- Macroeconomic factors like rising interest rates and rising inflationary environment puts the borrower in bit of risky situation of default. So, risk mitigation is required by the fund managers.

- Fund managers wants IBC laws to be stronger so that menu of options can be provided to creditors and borrowers to pull the situation out of stress and to truncate the amount of time required for the resolution of such matters.

Conclusion – Can this asset class help India to reach US$ 5 Tn economy?

The evolution of private debt as an asset class in India has been quite steady with more and more interest being shown by various players in the ecosystem. What will be the growth trajectory of Private debt in India? Well, the answer is not so simple as it would not only depend on India’s economy but also quite a lot on the global macroeconomic factors. The creation of physical and digital infrastructure in conjunction with efficiency-enhancing reforms will raise the contribution of productivity to growth. The economy is expected to continue seeing efficiency gains from reforms such as IBC. The MSME have been the very fulcrum of Indian economy. They have played a significant role in India’s growth story. There are around 63.8 million MSMEs bringing in over 111 million jobs, contributing 30% to the country’s GDP and accounting for 48% exports.[7] The big challenge that MSMEs face is the lack of access to formal credit. Only around 16% of MSMEs get access to loans from banks. Considering this huge market for demand, the private credit class has an important role to play in the future growth story of India to become US$ 5 Tn economy.

Authors for this article

- Atul Muchhala – Executive Director – Head India Operations

- Sandipan Saha – Associate Director – Business Development

Sources

- Preqin Global report 2023: Private Debt

- Press Release: ACC Publishes Financing the Economy 2018 (aima.org)

- https://www.aima.org/article/acc-publishes-financing-the-economy-2018.html

- https://www.mas.gov.sg/news/speeches/2023/private-credit-the-next-key-driver-of-growth-in-private-markets#:~:text=Private%20credit%20AUM%20has%20grown,2010%2C%20to%20222%20in%20202

- https://www.livemint.com/money/personal-finance/macroeconomic-tailwinds-to-propel-growth-in-private-credit-investment-and-aifs-11675525043120.html

- .https://economictimes.indiatimes.com/industry/banking/finance/banking/indias-retail-loan-volume-grows-to-near-commercial-loan-share-in-lending-market-study-shows/articleshow/94326001.cms?from=mdr

- https://yourstory.com/smbstory/msmes-potential-power-indian-economy-reach-5-trillion