Revolutionising finance: India’s fintech innovations break the mould

Posted on: January 14, 2024 | By: Team Multi-Act

As we stride forth into 2024, India, with its robust growth story, stands among the fastest expanding financial technology or fintech markets, on a global scale. The domestic fintech industry, which was valued at a market size of USD 50 billion in 2021, is forecasted to expand a staggering 3x, to reach a market value of USD 150 billion by 2025. Further, the burgeoning industry is expected to cater to a total addressable market valued at USD 1.3 trillion, by 2025, even as its assets under management rises to USD 1 trillion, by the end of the ongoing decade. This sustained expansion will be driven by fintech players’ ability to unlock optimal accessibility, offer efficient solutions, and create exceptional user experiences.

Assessing the evolving fintech landscape

Currently, the fintech adoption rate in the Indian economy stands at a stellar 87%, and this figure places the country at the top of the emerging markets cadre. The global average for fintech adoption is significantly lower at 64%, indicating India’s growing import in the global fintech arena. India’s booming fintech sector consists of four major segments – Payments, Digital Lending, InsurTech, and WealthTech – each of these verticals is expected to witness rapid expansion in the coming decade. While the payments vertical is forecasted to attain a transaction volume of USD 100 trillion by 2030, the digital lending landscape is expected to expand to USD 1.3 trillion, in the same period, from USD 270 billion in 2022. Further, the domestic InsurTech market, which is currently the second largest in the Asia-Pacific region, is estimated to expand by 15X, between 2022 and 2030, thereby attaining a market size of USD 88.4 billion, making India one of the quickest growing insurance markets, on a global scale. Lastly, the WealthTech vertical is expected to grow to a market value of USD 237 billion, by 2030, enabled by the rising retail investor base.

The ongoing fintech surge is powered by a number of factors. These include:

- The ongoing smartphone proliferation which has brought technology to the fingertips of over 600 million users

- An expanding middle class keen on differentiated and customised experiences

- The government’s future-ready initiatives encompassing Aadhaar, UPI, eKYC (Know Your Customer), and DigiLocker, have slowly yet surely transformed into the four pillars of the India Stack, which is a collection of digital infrastructure and enabling platforms

Going into 2024 and beyond, India’s unique demographic, growing affluence, and low financial penetration are creating opportunities for innovative fintech models that improve financial access, including full-stack solutions, new-to-credit lending, segment-specific financial services, and embedded financial products. Further, India’s tech talent and financial infrastructure are driving efficiency in fintech, with a focus on streamlining B2B payments, enhancing collaboration between fintechs and financial institutions, and providing tech solutions for identity and credit management. Finally, the sector is enhancing customer experience by offering seamless advisory and investment services, digitising small and medium-sized businesses, and catering to specific user segments with advanced financial solutions.

Assessing the evolving fintech landscape

The Indian fintech landscape, while burgeoning, does face several challenges which are impacting its growth and efficiency. A significant hurdle is the very low participation in capital markets, a sector that, despite digital advancement, still struggles with inclusivity. The digitisation of financial services, though increasing market participation, has concurrently spurred a rapid expansion in brokers and custodial services, often leading to market congestion and complexity. Additionally, the market faces issues with the loss of capital, often attributed to the quality of earnings and behavioural follies. To address these challenges, there is an ongoing shift towards curated thematic portfolios and rule-based algorithmic trading, with the aim of streamlining investment processes and enhancing returns. However, the inefficiency of brick-and-mortar financial services remains a concern, even as virtual banks and digital wealth management platforms gain traction, indicating a need for a more balanced and accessible financial ecosystem. And this is where the opportunity arises, with a focus on Enterprise SaaS (Software as a Service), cloud technology and its evolving applications in the Fintech ecosystem

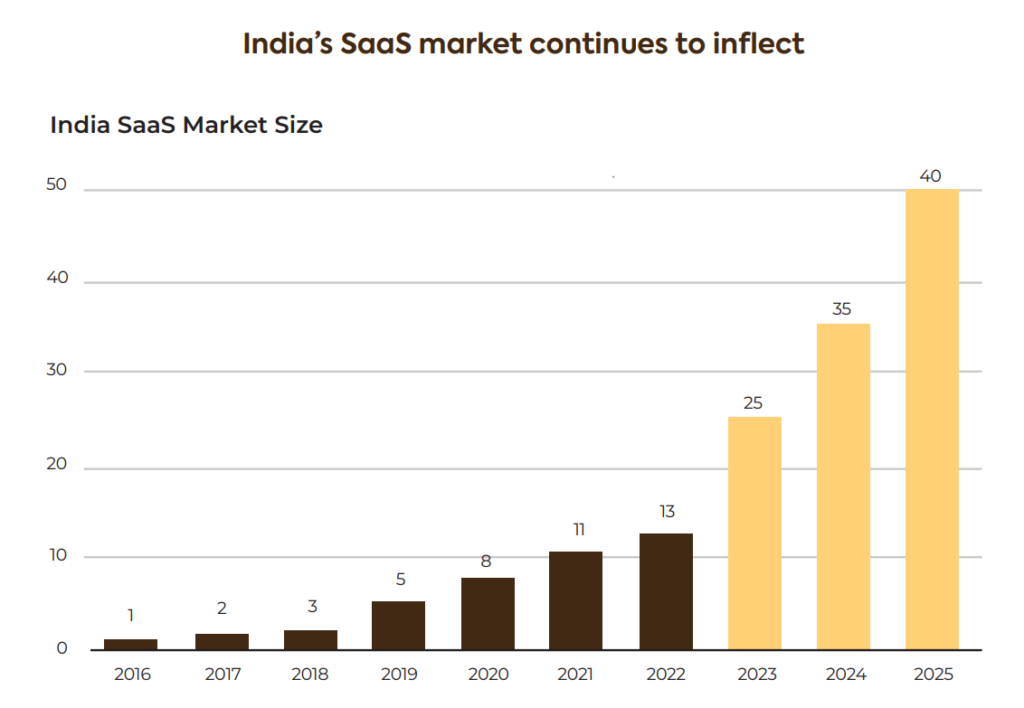

At present, India is the second-largest SaaS ecosystem, on a global scale, with the total annual recurring revenue (ARR) of Indian SaaS firms having grown four times to USD 12 – USD 13 billion in 2022, and investments having risen 6x to USD 5 billion, over the past five years. Going ahead, these companies are expected to grow at 20-25% per annum, thereby attaining an ARR of USD 35 billion by 2027 and USD 50 billion by 2030, thereby cornering around 8% of the global SaaS market in the next four years. Accordingly, in today’s high-interest rate environment, the domestic SaaS sector is uniquely positioned for optimal expansion, owing to its operational efficiency and innovative capabilities. These future-ready companies demonstrate higher efficiency metrics compared to their global counterparts, particularly in the U.S., across various stages of business development, due to a cultural emphasis on cost-effective scaling and the rapid development of additional products. In the current macroeconomic climate, this operational efficiency facilitates Indian SaaS companies’ expansion into international markets more smoothly than those in other countries.

The emerging growth narrative

With investors worldwide increasingly seeking efficient businesses with strong growth potential and cash flows, Indian companies, with their higher business efficiency scores, are becoming attractive investment opportunities, potentially leading to the availability of more growth capital. This capital influx has the potential to propel many Indian SaaS companies to global leadership. Furthermore, investing in India’s fintech infrastructure presents a unique opportunity, driven by factors like wider cloud adoption, the emergence of customer-centric products, and the limitations of banks and legacy systems. The COVID-19 pandemic has accelerated this shift, particularly in digital lending even as the banking sector is adapting to these changes by integrating cloud-based SaaS platforms for various functions such as underwriting, fraud detection, and customer engagement. Simultaneously, software products are emerging to support financial institutions in offering better services at lower costs and these developments are reimagining every aspect of financial service delivery including KYC, loan processing, and credit monitoring. India’s SaaS market is also set to revolutionise service delivery through Artificial Intelligence (AI), enhancing B2B services and creating software-enabled marketplaces.

In this evolving scenario, wherein enterprise SaaS’ contribution to the fintech ecosystem is poised to explode, investors can consider allocating a portion of their wealth to thematic alternative investment funds that offer exposure to this blossoming trend. Indeed, such AIFs, when equipped with the right deal-making capabilities, industry expertise, and the power to unlock optimal exit opportunities, can offer HNI investors a unique opportunity to tap into the expanding fintech landscape.