Please tell us about your objective behind setting up the Family Office Advisors Cohort.

Family office advisors play a crucial role in navigating the complexities and unique challenges faced by high-net-worth individuals and families. As the Indian financial landscapes evolve, individuals with substantial wealth require expert guidance to manage their diverse portfolios, intricate tax planning, succession planning, and philanthropic endeavors. Family office advisors specialize in providing tailored solutions that align with the specific goals and values of their clients, ensuring a holistic approach to wealth management. These professionals bring a wealth of expertise in investment strategy, risk management, and estate planning, offering invaluable insights to safeguard and grow family wealth across generations. By serving as trusted advisors, family office professionals contribute to the preservation and growth of family assets, fostering long-term financial stability and facilitating a seamless transfer of wealth to future generations.

The landscape of family office advisory services in India faces a notable deficit, reflecting a gap in the specialized expertise required to navigate the intricate financial affairs of high-net-worth families. Despite the substantial growth in wealth among India's affluent population, there exists a scarcity of qualified family office advisors who can address the unique challenges associated with managing and preserving substantial family fortunes. The dearth is attributed to factors such as a limited awareness of the family office concept, a nascent understanding of the comprehensive services it entails, and a shortage of professionals with the necessary skills in areas like wealth transfer, estate planning, and family governance. As India's economy continues to burgeon, there is an evident need for concerted efforts in educational initiatives, specialized training programs, and increased awareness campaigns to foster the development of a robust cadre of family office advisors capable of providing tailored and sophisticated wealth management solutions to meet the growing demands of high-net-worth families in the country.

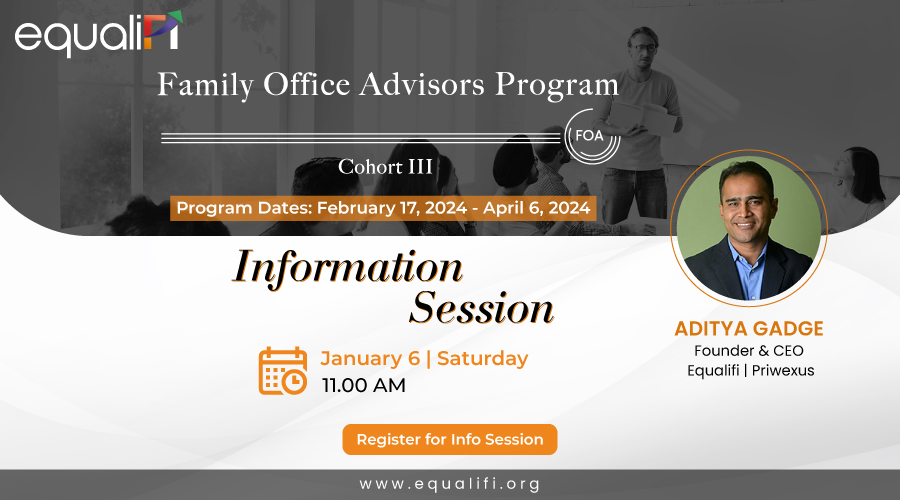

Equalifi’s Family Office Advisors Program (FOA) Cohort is an effort to plug this gap and contribute to a healthier and competitive family office advising ecosystem.

Can you elaborate on the importance of qualified family office advisors in today's financial landscape?

Absolutely. The financial needs of high-net-worth individuals and families have become increasingly intricate, necessitating the expertise of qualified family office advisors. These professionals play a pivotal role in managing complex financial portfolios, optimizing tax strategies, and planning for the seamless transfer of wealth across generations. With a comprehensive understanding of investment trends, risk management, and estate planning, family office advisors tailor their services to the unique goals and values of their clients. In an ever-changing economic environment, having a trusted advisor ensures that families can adapt their wealth management strategies to stay ahead of the curve and navigate challenges effectively.

How does the role of a family office advisor differ from traditional financial advisors?

While traditional financial advisors may focus on individual investments or specific financial goals, family office advisors take a more holistic approach. They consider the broader context of family dynamics, intergenerational wealth transfer, philanthropic goals, and complex structures like trusts and foundations. Family office advisors act as comprehensive wealth managers, offering a personalized touch that goes beyond mere financial transactions. This includes overseeing family governance, education for future generations, and addressing unique challenges that arise within affluent families.

What specific skills and qualifications are crucial for someone aspiring to become a family office advisor?

A successful family office advisor needs a diverse skill set. Firstly, a strong educational background in finance, accounting, or a related field is essential. Additionally, they must possess excellent communication skills to navigate the often-sensitive nature of family dynamics and wealth discussions. Technical expertise in investment management, tax planning, and legal aspects of wealth transfer is crucial. Furthermore, emotional intelligence and the ability to build trust are paramount, as family office advisors often become confidantes in matters extending beyond finance. Practitioner-led programs like the Family Office Advisors Program (FOA) or Professional certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) can also enhance one's credibility in this field.

How do family office advisors contribute to the long-term financial success of their clients?

Family office advisors contribute significantly to the long-term financial success of their clients by offering tailored, strategic guidance. They proactively identify opportunities for wealth growth while mitigating risks. Their in-depth knowledge of tax codes and estate planning helps optimize financial structures, ensuring efficient wealth transfer between generations. Moreover, family office advisors play a pivotal role in preserving family values and legacy, guiding clients through philanthropic initiatives, and facilitating open communication within the family. Ultimately, their multifaceted approach ensures that high-net-worth families can navigate the complexities of wealth management and thrive across generations.

Transitioning from a wealth advisor to a family office advisor involves acquiring additional skills, expanding expertise, and understanding the unique dynamics of affluent families. Here are steps to help wealth advisors make this transition:

Education and Certification: Pursue additional education in areas relevant to family office services, such as advanced financial planning, estate planning, and family governance. Obtain professional certifications, such as Chartered Financial Analyst or Family Office Advisors Program (FOA), to enhance credibility in the family office space.

Specialized Training: Attend workshops, seminars, and conferences focused on family office management, wealth transfer, and family dynamics to gain specialized knowledge. Seek mentorship or guidance from experienced family office advisors to understand the nuances of the role.

Build a Network: Connect with professionals already working in family offices to gain insights into the industry. Attend industry events, join professional associations, and engage in networking opportunities within the family office community.

Understand Family Dynamics: Develop a deep understanding of family dynamics, intergenerational wealth transfer issues, and the emotional aspects of managing family wealth. Familiarize yourself with strategies for facilitating communication and resolving conflicts within affluent families.

Expand Service Offerings: Broaden your service offerings to include comprehensive family office services such as estate planning, philanthropy management, and family governance. Collaborate with experts in legal, tax, and other relevant fields to provide holistic solutions.

Cultivate Trust and Confidentiality: Emphasize the importance of confidentiality and trust, as family office advisors often become intimately involved in clients' personal and financial matters. Showcase your ability to handle sensitive information and build strong, long-term relationships.

Develop Technological Proficiency: Familiarize yourself with technology platforms used in family offices for wealth management, reporting, and communication. Stay updated on advancements in financial technology to enhance efficiency and provide value-added services.

Demonstrate Success Stories: Highlight any relevant experiences or success stories from your career as a wealth advisor, emphasizing how your skills can be applied in the family office context. Showcase your ability to adapt to the unique needs and goals of high-net-worth families.

Stay Informed: Continuously educate yourself on industry trends, regulatory changes, and best practices within the family office space. Subscribe to publications and participate in forums focused on family office management.

Position Yourself as a Thought Leader: Share your insights through articles, blog posts, or speaking engagements to position yourself as a thought leader in family office advisory services. Leverage social media platforms to showcase your expertise and connect with the broader financial community. By taking these steps, wealth advisors can successfully transition into family office advisory roles, providing comprehensive and tailored services to high-net-worth families.