Reimagining Real Estate: Measuring the Unmeasured

Posted on: June 10, 2022 | By: Shiv Gupta , Founder & CEO, Sanctum Wealth

Abstract

Recent Mint series called “Guru Portfolio” has fund managers talking about their personal investment strategy. They talk about the allocation and the returns earned across various asset classes in their portfolio. However, when asked about the performance of their Real Estate allocation, most responded with an honest and unfortunate “NA”. Experience tells this to be true for many if not most of us. Monitoring and reporting financial portfolio is easy and investors are well aligned to reviewing the performance of these assets with their financial advisors. This is a standard practice, and it would be unacceptable if we had no data or information on the actual performance of these assets. Real Estate, on the other hand, generally accounts for majority of the investor’s net worth, and yet when we tried to review the performance of RE assets, we did not have the right tools to measure or manage them, until recently. Prop-tech is revolutionizing the Real Estate sector in many ways. From a wealth management point of view, Prop-tech enables the standardization of the reporting of real estate like the financial assets. This facilitates the ability to compare performance across asset classes. Many firms are working on digitizing the raw real estate data and powerful analytical tools are becoming widely available. These provide a better understanding of the market, recognize investment opportunities, and enable informed decision making in an otherwise historically fragmented and opaque space. Prop-tech is helping bring the same level of transparency and accuracy in managing and monitoring real estate portfolios that we enjoy with other financial assets. This is exciting and there are many more advantages to be explored.

Introduction

The quote “what gets measured gets managed” Is famously attributed to Peter Drucker. It seems obvious at first glance, given that we cannot possibly manage something that isn’t measured. However, when we dig a little deeper, two surprising elements reveal themselves:

First, according to none other than the Drucker Institute, Drucker never said those words.

Second, the idea itself is flawed.

V. F. Ridgway published a paper in 1956 criticizing the measurement mantra in performance measurement. Ridgway was onto something because not everything we can measure matters. Not everything that matters can be measured.

The second half of the above statement hits home regarding real estate investments (things that matter). Until recently, we did not have enough tools to efficiently and effectively measure or manage them.

Items in your cart

A portfolio review is standard practice across the wealth management industry, and investors expect it regularly from their financial advisors. Typically, these discussions involve only financial assets such as stocks, mutual funds, bonds, and cash equivalents. Monitoring and reporting of financial assets are easy as data is readily available —however, the tune changes when real estate joins the party.

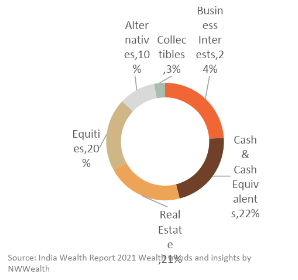

A recent series called “Guru Portfolio” in a leading daily has fund managers discussing their personal investment strategy. They discuss their asset allocation and the returns earned across various asset classes. However, when asked about their real estate allocation performance, most responded with an honest and unfortunate “Not Available.” This response is interesting because real estate is a much-preferred asset class, given its tangible nature, dependable income, and collateral value. Popular estimates suggest that at least 21% of wealth is allocated to Real Estate in India* yet experience over the years shows us that this asset class doesn’t typically make it to the portfolio discussions and reviews.

This experience has some context, and the reasons are important to understand:

- Traditionally, the Real Estate sector has been highly fragmented and opaque, leading to the absence of credible and transparent data

- Reliance on information from market intermediaries makes information inconsistent, leading to greater inefficiencies

- There is no central exchange like the NSE or the BSE, and all deals are privately negotiated, making price discovery difficult

- No asset is alike in Real Estate, and these nuances can have an impact on demand and price. Also, these assets are not traded frequently, making price discovery challenging

- Owners can be emotionally connected with the physical asset, thus overestimating its value

- The lack of benchmarks has made Real Estate investments prone to speculation and guesstimation at best

Since the information available is more hearsay, the assumption of how the asset is fairing can be highly misleading. These challenges make it difficult for investors and financial planners to review the value and performance of the Real Estate assets efficiently and accurately. Consequently, over decades these challenges have led to behavioural biases when thinking about real estate assets – such as not considering real estate as part of the overall portfolio and thus not reviewing or measuring it objectively.

PropTech: The Big Picture

PropTech is making significant strides in the entire lifecycle of real estate development and management. By building efficiencies, PropTech enables a better construction cycle with reduced timelines and at a lower cost. Technology has facilitated the use of better construction materials, reducing the carbon footprint of buildings and making them ESG compliant. It makes property and tenant management more dynamic, creating a collaborative work environment with improved efficiency. For example, tools are available for effective rental management through SaaS-based platforms. Virtual reality helps visualize the project in detail during the planning stage. Developers, too, love virtual reality to provide digital experiences of visiting a project instead of physical site visits.

While this is in no way an exhaustive list of changes the industry is experiencing, the exciting news is that PropTech is making the sector more transparent and information more reliable.

The newly evolved prop-tech platforms leverage the potential of new technologies like Artificial Intelligence, Big Data, Cloud, and more to enable these benefits.

The tech using algorithms can access and digitize millions of property registration records across the country. Combining this with online listing information transforms raw data into valuable and discernible insights and analytics. The availability of such insights removes guesswork and reduces biases, thus making informed decision-making possible.

PropTech and Portfolio Management

A few companies have provided insights for B2B real estate transactions for many years. However, new PropTech players have enabled the democratization of this information, and this is excellent news, especially for HNI investors and wealth management firms like Sanctum Wealth, who are enthusiastic adopters of such technology. These PropTech tools provide market intelligence which can be helpful in many ways:

- Understand the current market value, past performance, and return on real estate investments

- Help make educated buy/sell decisions, with access to information such as recent and past transactions.

- Know the properties’ true worth to facilitate estate planning

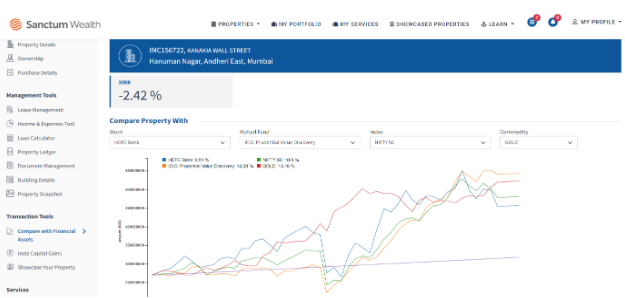

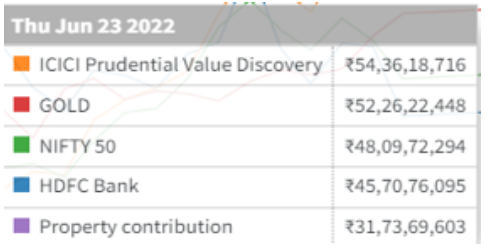

From a wealth management point of view, this is revolutionary and enables standardization of real estate reporting like any other financial asset. *See Image 1

Image 1: Comparing an investment in a commercial asset across various financial investments such as stock, mutual fund, index, and gold (Sanctum Real Estate Aggregation Platform enabled by Props AMC)

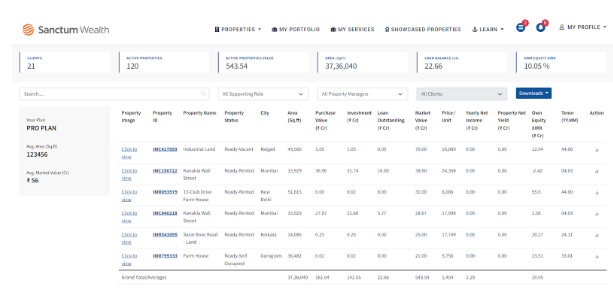

PropTech not only facilitates better assessment and evaluation of a property’s financial performance but also helps automate the entire process of property management. These features enable bringing the overall lifecycle of real estate ownership and management on an efficient and transparent platform, which is empowering, convenient, and intuitive.

Image 2: Organizing real estate holdings in an intelligent dashboard to evaluate financial performance (Sanctum Real Estate Aggregation Platform enabled by Props AMC)

Future Ready

Technology has gradually seeped into almost all facets of the real estate sector, and wealth (property) management is no exception. As investors and financial planners, we must take advantage of the new tools at our disposal. PropTech enables us to monitor our investments and make managing real estate easier. It also allows us to make better and more informed decisions that can help generate and protect wealth.

So, why would Ridgway or Drucker say that measuring or managing something may be pointless? Well, because measuring what matters can be difficult and perhaps even impossible. But when it comes to real estate assets, we know that they not only matter, but they can also be measured too.